Small business finances can feel stressful because they mix money, time, and uncertainty.

A few steady habits can make cash flow clearer and tax season calmer.

This guide outlines practical routines that support growth without overwhelm.

Running a small business often means you are the product, the marketing department, and the operations team at the same time. Money becomes emotional because it’s tied to effort and identity. That’s why financial habits matter: they reduce stress by turning chaos into a routine.

This guide focuses on habits that work for real people. You don’t need perfect spreadsheets. You need clear accounts, simple tracking, and predictable moments in the month when you look at the numbers.

Separate business and personal money

This is the foundational move. Separate accounts make everything easier: bookkeeping, taxes, and understanding whether the business is actually healthy. Mixing money blurs the picture and creates anxiety because you can’t tell what’s happening.

Even if you’re small, treat the business like a distinct entity. Pay yourself in a consistent way if possible. That one change improves clarity fast.

Create a one-page money dashboard

You don’t need complex reports. A one-page dashboard can include: cash in bank, expected invoices, upcoming bills, and your monthly “minimum survival number” (the amount you need to keep the lights on).

Review it weekly. Ten minutes can prevent big surprises. The goal is to catch issues early and make calm adjustments.

Use state resources to reduce friction

Many owners try to solve every problem alone. That can be admirable, and it can also be unnecessary. There are programs, guidance, and support structures that can help with planning, growth, and compliance.

Small business support: leveraging state resources for growth is a helpful overview of ways to build capacity without reinventing everything yourself.

Build a quarterly routine for taxes and planning

Tax stress often comes from avoidance. A quarterly routine turns taxes into a normal task rather than a panic event. Put a recurring calendar reminder. Gather documents, review profit, and set aside a percentage for tax obligations.

If you operate in Wisconsin or need a framework for forms and requirements, Wisconsin taxpayer guide can help you build a clearer admin process.

Investing and long-term thinking for business owners

Business owners sometimes pour everything back into the business and neglect personal investing. That can be risky. Diversifying your long-term plan can reduce pressure on the business to be your only future.

If you want a straightforward overview of investing concepts, Investment basics: building wealth for the future is a good reference for building a steady long-term habit alongside business growth.

A money habit checklist you can implement this month

Use this checklist as a starter kit. It’s designed to be realistic:

- Separate accounts: open a business checking account and use it consistently.

- Weekly dashboard: track cash, invoices, bills, and your minimum number.

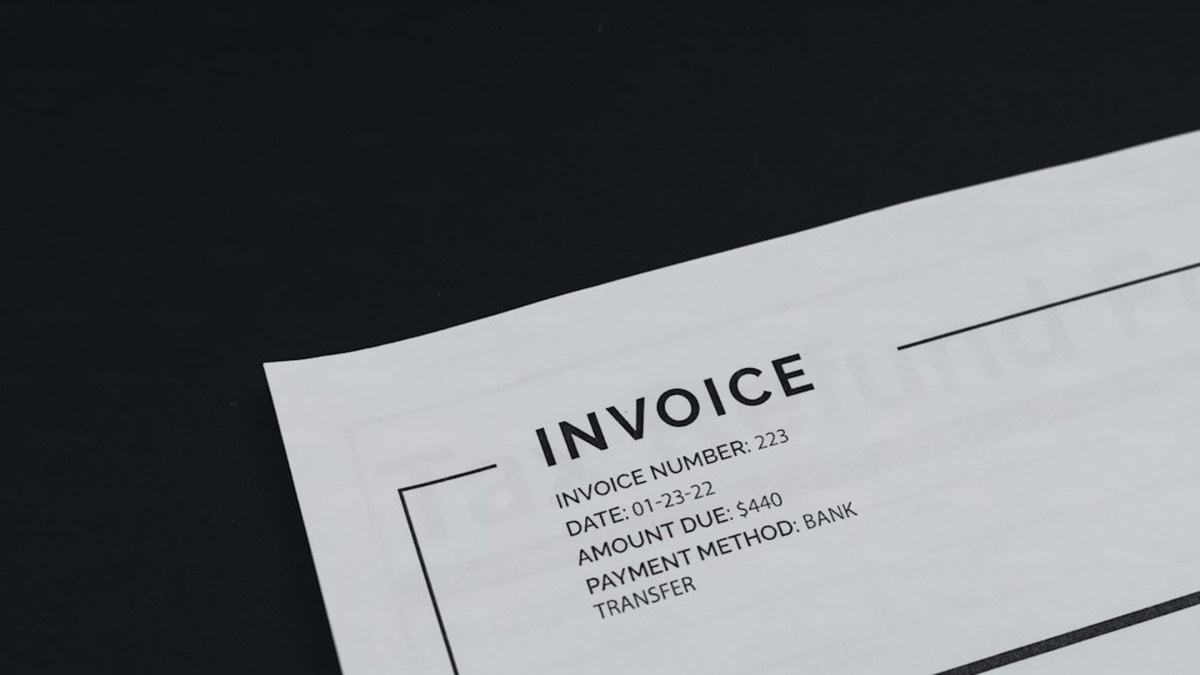

- Invoice rhythm: send invoices on set days to protect cash flow.

- Quarterly tax prep: set aside money and gather paperwork on schedule.

- Owner pay plan: pay yourself predictably when possible.

Stop confusing revenue with stability

High revenue can still mean stress if cash flow is uneven and expenses are unpredictable. Stability comes from margin, reserves, and a routine that helps you see problems early. That’s why dashboards and quarterly reviews matter more than big months.

Choose one improvement at a time

Trying to overhaul everything at once can backfire. Choose one habit, install it, then move to the next. Many owners find the biggest relief comes from separation of accounts and a weekly dashboard. Once those are in place, taxes become less scary, and growth decisions become clearer.

Small business is hard work. Money habits won’t remove every challenge, but they can remove the constant background fog. With clearer numbers, you’ll make calmer choices, and calm choices are often the ones that lead to sustainable growth.